What Is Hyperliquid?

Imagine a world where you can trade cryptocurrencies in real time, enjoy the low slippage of a top-tier centralized exchange (like Binance or Coinbase), and maintain full ownership over your assets. Hyperliquid makes that vision a reality. It’s a relatively new Layer 1 blockchain platform tailored for high-speed, low-slippage trading—giving users the best parts of traditional financial markets without sacrificing the core principles of decentralization. With its native HYPE token, Hyperliquid has become a rising star in the DeFi (decentralized finance) space, blending community-focused values with professional-grade trading tools.

In this guide, we’ll delve into why Hyperliquid has gained so much attention, explore its core features, and break down what sets it apart—especially if you’re accustomed to more conventional decentralized exchanges (DEXs) or centralized exchanges (CEXs). From its origin story and token distribution to bridging details and a playful meme coin ecosystem, you’ll gain a comprehensive understanding of how Hyperliquid works and whether it might fit your trading or investing strategy.

Hyperliquid – The biggest decentralized exchange (DEX)

Every day, thousands of traders move trillions of dollars across blockchains and exchanges in search of bigger profits, better liquidity, or fringe investment opportunities. You may already know about Automated Market Makers (AMMs), which power many DEXs on Ethereum and other popular chains. While AMMs have advanced DeFi immensely, they often introduce high slippage—especially when large trades occur in thinly liquid pools.

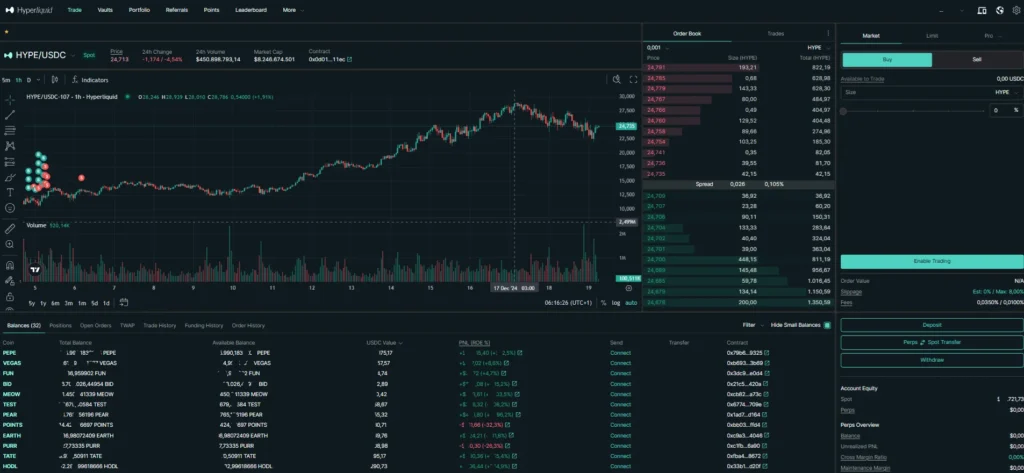

Hyperliquid aims to solve this problem by adopting an orderbook-based approach on a dedicated high-performance Layer 1 blockchain. In essence, it merges the speed of centralized trading systems with the self-sovereignty of decentralization. This structure could make crypto trading more fluid, safer for user funds, and more appealing to a broader crowd—including serious, high-frequency traders who normally stick to CEXs.

Additionally, Hyperliquid made headlines with its major airdrop of the HYPE token. By issuing tokens directly to the community—rather than focusing on private or venture-capital funding—Hyperliquid set a precedent for a more user-friendly and fair token distribution. This “community first” ethos is fundamental to the project’s identity.

Getting to Know the HYPE Token

At the heart of Hyperliquid’s ecosystem is the HYPE token. Think of it as your entry ticket to governance privileges, special platform perks, and a potential share of future rewards. While each blockchain has its own unique token model, HYPE stands out due to its distribution model and the fact that it serves multiple functions:

- Governance and Proposals: HYPE holders might vote on proposed changes, improvements, or new features. This could range from adjusting platform fees to introducing new trading pairs.

- Platform Utility: HYPE might be used for reduced trading fees, staking in liquidity pools, or securing more advanced features as the ecosystem matures.

- Community Rewards: Because over three-quarters of the token supply is earmarked for users (past, present, and future), HYPE acts as a unifying asset that promotes long-term community growth.

What truly stands out is the lack of a large private investment allocation. In many other crypto projects, big venture capital investors control a significant portion of the token supply. Hyperliquid flips that dynamic, ensuring more tokens end up with traders and users who engage with the platform.

A “CeFi-Like” Trading Experience, But in DeFi

Most decentralized exchanges rely on AMMs—pools of tokens that automatically adjust prices based on supply and demand. Although this was a significant leap forward in DeFi, it’s not always perfect. Rapid price swings and large trades can produce unfavorable slippage and unexpected costs.

Hyperliquid is different. It uses an on-chain orderbook, a common method for big centralized exchanges. By matching buyers and sellers directly at specific price levels, Hyperliquid can reduce slippage to a minimum. The chain is specifically designed to handle high throughput, so you get:

- Near-instant confirmations.

- Transparent order matching.

- A familiar market/limit order system akin to what you’d see on Coinbase’s advanced trading interface or Binance’s spot market.

This can be a substantial advantage for traders who find AMMs unpredictable or slow. Meanwhile, users never relinquish control of their private keys, staying true to DeFi’s decentralization ideals.

Major Features That Make Hyperliquid Unique

- High-Performance Layer 1

Unlike many DeFi apps that operate on top of another chain (such as Ethereum or BNB Chain), Hyperliquid stands on its own blockchain. This independence allows the team to optimize block production, consensus mechanisms, and transaction speeds with traders in mind—resulting in a specialized chain focusing primarily on reliable, speedy order executions. - Leveraged Trading

Beyond simple spot trading, Hyperliquid provides leverage up to 50× for popular assets like Bitcoin or Ethereum. While high leverage can multiply profits, it can also magnify losses—so it’s crucial to understand margin trading and risk management before diving in. - Copy Trading and Vaults

If you’re not ready to trade actively or prefer to trust more experienced traders, you can allocate your capital to “vaults.” Essentially, these vaults mimic the strategies of top traders on the platform. If the selected vault manager performs well, both parties share the rewards. Always do your due diligence because there’s never a guarantee of profit. - Liquidity Provision

Hyperliquid allows users to deposit stablecoins (often USDT or USDC) into liquidity pools from which margin traders can borrow. In return, you earn a share of the trading fees or interest. At peak times, reward rates can be impressive, but keep in mind these rates fluctuate with market conditions. - Community-First Governance and Funding

With a dedicated portion of tokens allocated to community grants and the Hyper Foundation, there’s a structured way to propose enhancements, develop tools, or build out new features—further fostering a sense of collective ownership.

The Meme Tokens: PURR and PEPE

Crypto isn’t all about professional traders and advanced strategies. Many enthusiasts enjoy engaging in the fun, meme-driven side of the market. Hyperliquid accommodates that as well. Tokens like Purr (PURR) and Pepe (PEPE) are part of the ecosystem, catering to users who love meme culture, NFT collaborations, or playful DeFi experiments.

While these coins can be unpredictable or speculative, they also help illustrate Hyperliquid’s broader goal: attracting serious traders and casual, community-driven participants. This inclusive environment enriches liquidity and fosters a vibrant user base.

Bridging to Hyperliquid: Getting Started

1. Prepare Your Wallet

Before trading on Hyperliquid, you need a crypto wallet that supports Arbitrum (a popular Layer 2 on Ethereum) and custom network settings. We recommend Rabby Wallet, but others, like MetaMask or similar, should also work.

2. Bridge Assets

Currently, the easiest way to move funds to Hyperliquid is by bridging from the Arbitrum network using stablecoins like USDC or USDT. This process typically involves:

- Connecting your wallet on Arbitrum.

- Navigating to Hyperliquid’s official bridging page or a partner bridge.

- Approving the transaction and waiting a short while for confirmation.

3. Start Trading

Once your funds have arrived on Hyperliquid, you can navigate to the official trading interface—app.hyperliquid.xyz/trade. You’ll find an order book, like on a traditional exchange. You can place market or limit orders, explore leveraged positions, or deposit into liquidity pools.

4. Manage Risks

As with any DeFi or leveraged trading environment, always trade cautiously. Start with smaller amounts if you’re new, and only risk what you can afford to lose. Hyperliquid’s user-friendly interface does streamline the process but doesn’t eliminate the inherent volatility of crypto markets.

The Airdrop That Sparked a Buzz

Hyperliquid’s famous HYPE airdrop took place on November 29, 2024, distributing tokens to approximately 94,000 wallets. Unlike many other projects, there was no private investor presale to overshadow retail participants. This bold approach led many to label Hyperliquid a “community dream project,” as a large chunk of the token supply ended up with actual users rather than big-money funds.

One of the most surprising aspects was how HYPE’s price rose post-airdrop—a rarity when many airdrops see quick sell-offs. This phenomenon could suggest that recipients believe strongly in Hyperliquid’s potential or prefer to stake or trade the token on the platform rather than dumping it for fast gains.

Potential Challenges and Risks

- High Market Volatility

Bitcoin, Ethereum, and other crypto assets are notoriously volatile. This volatility is amplified for leveraged trades, so it’s crucial not to over-leverage, especially in rapidly changing market conditions. - New Technology

While Hyperliquid has proven stable, it’s still a newer project. Always remember that emerging platforms can face unforeseen technical issues, liquidity constraints in some token pairs, or evolving governance decisions. - Bridging Complexities

Bridging assets between different blockchains or Layer 2 solutions can sometimes be confusing. A small mistake, like sending tokens to the wrong address, can be costly. Triple-check every transaction when bridging. - Unknown Future Developments

Although the team shares a general roadmap, features like additional bridging support, expanded meme tokens, or second-round airdrops aren’t guaranteed to pan out exactly as the community hopes. Governance changes may shift tokenomics or create new rules.

The Road Ahead: What Might Be Next?

Hyperliquid’s approach is ambitious. Having allocated nearly 39% of the token supply to future initiatives and emissions signals that more expansions, promotions, or new user rewards could be on the horizon. Some areas of speculation include:

- Cross-Chain Integrations: Broadening support beyond Arbitrum or adding layer-2 bridging for networks like Optimism, BNB Chain, or Polygon.

- Collaboration with Institutional Players: If professional trading firms inject deep liquidity, Hyperliquid’s order books could rival established centralized exchanges.

- Enhanced Privacy Features: Tools like zero-knowledge proofs might be implemented, making private or confidential trading possible.

- Governance Upgrades: More community proposals (HIPs: Hyper Improvement Proposals) could continue shaping how token emissions, airdrops, or new token listings are handled.

Ultimately, the success of these efforts will depend on community engagement, technological breakthroughs, and the broader market’s appetite for new forms of DeFi trading.

Final Thoughts: Is Hyperliquid Right for You?

Hyperliquid represents a fresh take on decentralized trading. By steering away from the typical AMM model and establishing an order book-driven Layer 1 chain optimized for speed, it aims to deliver the seamless experience found on today’s best-centralized exchanges—without giving up the benefits of on-chain transparency and user self-custody.

The HYPE token airdrop added to the platform’s appeal, sparking a robust community excited to explore leveraged trading, liquidity provision, copy trading vaults, and even playful meme coins. Yet, as with all crypto ventures, it’s important to tread carefully. Market swings, bridging complexities, and new technology challenges mean risk is always involved.

If you’re comfortable navigating novel DeFi platforms and want an exchange-like trading experience underpinned by real decentralization, Hyperliquid could be a compelling option. Remember to start small, research, and check your risk management rules. Whether you’re a seasoned trader or a curious newcomer, Hyperliquid’s track record of community focus, fast settlements, and forward-thinking solutions might make it a key platform to watch—and possibly participate in—as the DeFi landscape evolves.

You can save 4% on your fees by using our Hyperliquid Referral Code!

Disclaimer: This text is for informational purposes only and should not be considered financial advice. Always research (DYOR) and consult professional guidance before engaging in cryptocurrency or DeFi activities.