What is Bitcoin?

Bitcoin (BTC/XBT) is a decentralized, digital currency based on blockchain technology. The system works without a central bank or a single administrator. Bitcoin is the world’s first cryptocurrency and was invented by an unknown person or group of people using the name Satoshi Nakamoto. The total amount of bitcoins is limited to 21 million.

Double-spending problem

Until 2008 all digital currencies had a major problem that could only be resolved by a central institution like a central bank. This problem is called “double-spending” and it allows users to spend the same single digital token more than once. Double-spending can lead to inflation and devaluation of a currency.

In 2008 Satoshi Nakamoto released the whitepaper “Bitcoin: A Peer-to-Peer Electronic Cash System”, which offered a solution for the double-spending problem with blockchain technology.

Please enter CoinGecko Free Api Key to get this plugin works.

How does Bitcoin work?

Bitcoin is based on blockchain technology. We already explained how blockchains work in our basics. Bitcoins consensus mechanism is proof of work and the utilized hash algorithm is SHA-256, which is considered very secure. To access the Bitcoin network, you have to download a client (a wallet). The original client by Satoshi Nakamoto is called “Bitcoin Core”. However, there are many other wallets that offer extra functionality like support for multiple cryptocurrencies.

By opening a wallet, you receive a public address and a private key. The private key is the key to do bitcoin transactions. Furthermore, the public address is for receiving transactions. Every bitcoin wallet contains one or more private keys and public addresses. The private keys are mathematically related to all Bitcoin addresses generated for the wallet. It is mathematically very easy to generate the public address from a private key. However, it is impossible to generate a private key from a public address. Moreover, it is not possible for others to correctly assign public addresses to coin owners. That’s why Bitcoin is an anonymous system. One disadvantage, however, is that a lost private key makes your bitcoin worthless.

Is Bitcoin anonymous?

Even though you theoretically can’t assign the public address to the coin owner, transactions on the blockchain are still fully transparent and traceable. Once a coin owner is associated with a certain address, all transactions to and from this address can be traced. Furthermore, cryptocurrency exchanges demand extensive KYC (= know your customers) processes to verify the identity of their clients. This is why Bitcoin is only semi-anonymous and not suitable for illegal activities.

Scalability issues

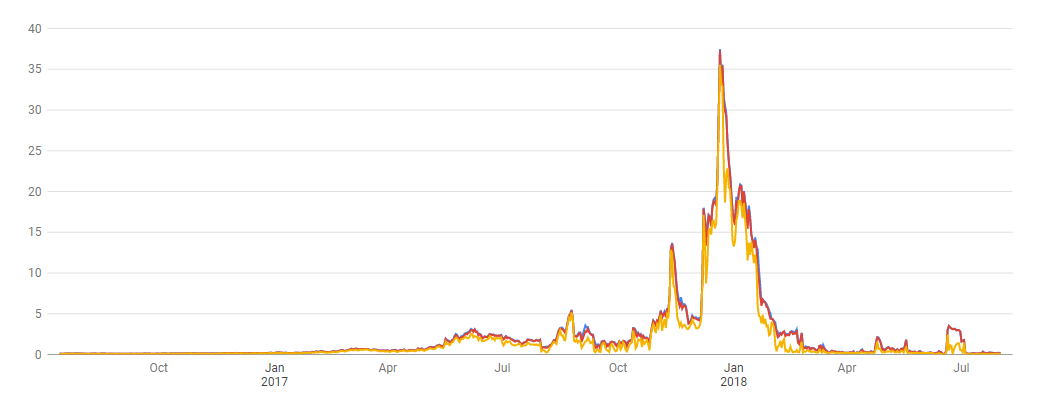

As Bitcoin is one of the original cryptocurrencies, it’s technology is less advanced than some of the newer coins. This makes Bitcoin less scalable than for example Ripple or NEO. Bitcoin is one of the more popular cryptocurrencies and that’s why its price has skyrocketed in late 2017. At the same time, however, transaction speed and cost have also increased because more people bought Bitcoin. Bitcoin currently allows only for 7 transactions per second, which is way to small compared to credit institutions like Visa, which currently supports up to 24,000 transactions per second. Transaction fees have gone up to 35$ in late 2017. There have been several proposed solutions for this issue. The scalability issue has also led to the hard fork Bitcoin Cash. There has been a debate in the community about increasing the block size which would allow for faster and cheaper transactions. Bitcoin Cash is a version of Bitcoin that increases the block size from one to four megabytes. However, there are not only advantages to increasing the block size. An increased block size leads to more centralization because miners will have less chance and resources to verfiy blocks compared to big mining farms.

Development of Bitcoin transaction fees // Source: https://bitcoinfees.info

SegWit

SegWit (“Segregated Witness”) is a soft fork for the Bitcoin blockchain which allows for faster and cheaper transactions without increasing the block size limit. With SegWit the signature (“witness”) of a Bitcoin transaction is not put into the transaction file. This allows for smaller transaction files so more transactions can be put into a block. SegWit was activated on August 24th 2017. However, it took a few months for users and miners to update their software to implement SegWit.

Lightning Network

The Lightning Network is a second layer payment protocol that operates on top of the blockchain of Bitcoin. It was proposed in 2015 by Joseph Poon and Thaddeus Dryja to solve scalability issues of the Bitcoin blockchain. Lightning is a decentralized network using smart contract functionality in the blockchain to enable faster and cheaper payments across a network of participants. The technology is currently in a testing phase.

How does Lightning work?

Two participants create a payment channel on the network. They both deposit a certain amount of Bitcoin in a multi-signature address. The address works like a safe that locks both funds away, it can only be opened when both parties agree. By opening the channel, a balance sheet is created that shows exactly how the funds in the multi-signature address are distributed. Opening the payment channel happens on the main blockchain for more transparency. Both parties can see on the balance sheet how much they both have deposited so they both can be sure that they get their money once the channel closes. To make a transaction happen, both parties update their balance sheets so that Party A sends money to Party B in exchange for a good or a service. If both parties agree with the transaction they sign the updated balance sheet with their private keys. They both receive a copy of it. The parties can do infinite amounts of transactions on the channel, as long as they have enough balance. The payment channel can be closed at any given time by both parties. To do so they have to take the latest balance sheet, which is signed by both parties, and send it to the bitcoin network. Miners will then validate the signatures on the balance sheet and release the funds according to the balance sheet.

The most important thing: You don’t need to open a direct payment channel with everyone you want to send Bitcoins to. You can use already existing channels to find a path across the network to any party you want to send money to. Big cooperations or institutions will act as middlemen, so-called “nodes”. They have payment channels with many other users on the network so users can use these nodes to send money to almost everybody on the network without having to open a payment channel to do so.

How to buy Bitcoin

Bitcoin is the most popular digital currency, which is why it’s relatively easy to find an exchange to buy it. For a full list of Bitcoin exchanges visit bitcoin.org. One of the easiest exchanges to use is Coinbase. It is a trusted exchange that accepts a variety of currencies to exchange Bitcoin and select other cryptocurrencies for.